Quick Summary

- Return policies are now a deciding factor for online shoppers, with 77% checking the policy before buying.

- European retailers saw $743 billion worth of goods returned in 2023.

- 30% of online products are returned, compared with just under 9% from physical stores.

- Poor return experiences matter, with 67% of shoppers refusing to buy again after a negative return process.

- Processing a return often costs around 30% of the item’s value, and peak seasons see return rates rise by 17%.

- Nearly half of shoppers (47%) have used parcel shops or lockers for returns, showing strong demand for out-of-home options.

Return policies have become one of the most important factors for consumers when deciding whether to make online purchases. Shopping habits have changed, and convenience is now a top priority for buyers. However, convenient returns for consumers do not always translate to convenient processes for retailers.

The global reverse logistics market was valued at $731.9 billion in 2023 and is projected to reach $1.2 trillion by 2033.

Despite the size of this market, many retailers lack streamlined return policies or have no standard returns process at all.

We have compiled the following data resource to help retailers understand the value of a simple, efficient, and customer-friendly returns policy.

1. The Scale of Returns in Retail

Table 1: Overall Retail Impact

The financial size of returns is incredibly high. European retailers, for example, saw $743 billion worth of purchases returned in 2023. This highlights the vast number of eCommerce purchases as well as a change in consumer buying patterns.

A whopping 30% of online items are returned, compared to just under 9% from physical stores. This suggests that people are perhaps making more impulsive purchases online, whereas in-store purchases are thought through ahead of time, given the need to visit the store in person.

For items like clothing, consumers often buy multiple variations with the intention of returning the ones that do not fit later. This “try before you buy” behaviour has created numerous challenges for retailers from warehousing to routing, and contributes to revenue losses of around $400 billion each year.

2. Customer Expectations and Behaviour

Table 2: Buyer Behaviour and Expectations

A clear return policy has become a key differentiator for businesses with 77% of online shoppers checking return policies before purchasing.

If the policy seems confusing or restrictive, many will leave the site before placing an order!

‘Bracketing’ is a common practice, particularly for fashion purchases. It’s a process where customers buy multiple sizes or colours with the intention of sending most items back. This has actually become quite a standard behaviour, with 63% of shoppers admitting to bracketing.

This trend alone accounts for a significant portion of return volume and creates new challenges for demand forecasting, inventory management and returns logistics.

With returns now being a big part of buying behaviour, many shoppers are discouraged to find they have to pay for return shipping (a staggering 30% of consumers actually find paid returns to be more annoying than jury duty!). And 67% wouldn’t shop with a retailer again after a negative return experience.

3. Return Reasons

Table 3: Why Shoppers Return

Size and fit remain the dominant driver behind returns, for apparel brands in particular (this simple reason is responsible for almost two-thirds of all returned items). This further proves the number of shoppers ‘bracketing’, however, it also may suggest there is an industry-wide issue regarding standard sizing, or lack thereof.

A combined 43% of returns come from incorrect items or damage. A further 22% of items are returned due to the item being different to what was pictured onsite. These issues contribute to the substantial cost of returns and could be fixed relatively easily by implementing stricter picking processes and training staff to handle fragile items with more care.

Otherwise retailers face losing 20-65% of the item's original value due to repacking, resale timing and handling costs.

4. Cost Pressures on Retailers

Table 4: Cost and Process Impact

Processing returns is expensive, often consuming around a third of the original sale price. Peak season doesn’t help, many retailers experience return rates 17% above normal during holidays and hire additional staff to handle the surge!

Wardrobing also adds unique challenges (where items are purchased for a specific event and returned after use). Nearly 70% of shoppers admit to buying items for one-time use with plans to return them. This of course adds another huge cost burden to retailers, and unfortunately, there's usually little that can be done to prevent this type of purchasing.

There are ways retailers are experimenting to regain some of these losses. One such way is by charging customers for processing their returns. Some offer drop-off options to lower carrier expenses, and 33% (including Target and Amazon) have adopted the ‘keep it’ refund model by processing a refund without taking the item back. You can see why when you consider some retailers are throwing away over 25% of their returns. Likely due to returns not being the item originally sold, the items are in poor condition or the cost to resell the item isn’t worth it.

5. Out of Home Returns and Collection Preferences

Table 5: Collection and Drop Off Trends

Out-of-home returns have grown quickly due to convenience with Parcel lockers and are particularly attractive to younger shoppers and those living in cities. Nearly half of online shoppers (47%) have brought an item to a parcel shop or locker, reflecting a widespread move toward out-of-home returns.

These options appeal to buyers who want control over timing or who prefer not to wait for home collection.

Home collection has a strong appeal, with 47% of shoppers saying they would pay for a quicker pickup. Offering multiple return methods is increasingly essential since preferences vary widely by region and age group.

Tips for Retailers

Below are practical steps retailers can take to lower return rates, reduce operational pressure and improve customer satisfaction.

1. Strengthen the clarity and visibility of your return policy

Shoppers often look for return policies before reading anything else on a product page. A clear, simple returns policy can reduce uncertainty and prevent abandoned carts.

Avoid long paragraphs, complicated conditions or unclear time windows. Place the policy link near the product description, and repeat it during checkout. This adds reassurance at every stage of the buying journey.

2. Offer multiple return options (if possible)

Return preferences vary by age group, region and product type. Providing parcel shop drop offs, lockers, home collection and in-store returns gives customers flexibility.

Even adding one additional option can reduce frustration and support higher repeat purchase rates. It also helps you balance operational costs because you can guide customers toward the most efficient method for your business.

3. Reduce sizing related returns

Size and fit issues account for a large portion of returns. To reduce this, brands should provide clear measurement tables, comparison charts, customer reviews and true-to-life product photos.

For apparel, including notes such as “relaxed fit” or “fits smaller than usual” can prevent uncertainty. If your budget allows, consider using virtual try-on tools, which reduce the need for shoppers to buy multiple sizes.

4. Introduce automation for routing and collection

Returns often arrive in unpredictable waves, which creates scheduling difficulty for delivery teams.

Routing platforms like SmartRoutes can support collection planning by suggesting efficient pickup routes, grouping returns geographically and helping teams communicate with customers about collection times.

5. Identify and address avoidable return causes

A meaningful portion of returns comes from preventable issues such as delays, damaged items or incorrect products.

Review these cases regularly to spot patterns. If damage rates rise for specific products, improve packaging for those items. Consider tighter checks when it comes to picking processes.

Something as simple as a monthly internal review could help to reduce avoidable return volume.

Strong Returns Processes Matter More Than Ever

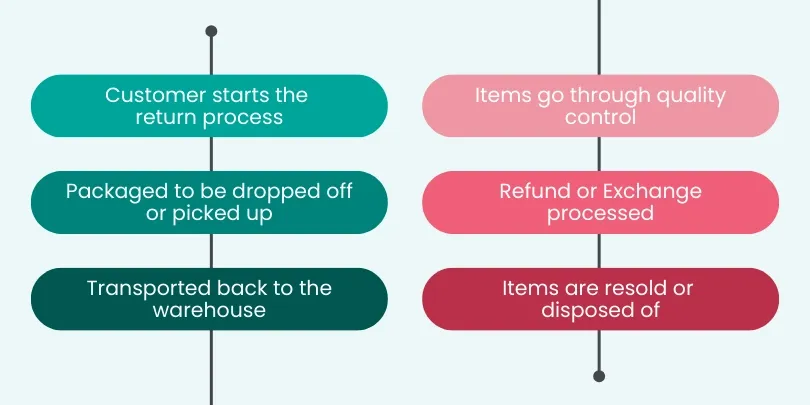

Returns are a part of everyday shopping habits. With nearly a third of online orders coming back to the warehouse, retailers face real pressure to keep costs under control while still keeping customers happy.

There is an obvious need to reduce return volumes, but there is also a need to prevent avoidable problems like damaged items or incorrect products, which together account for almost half of all returns.

Many of these challenges facing retailers can be reduced with practical adjustments. Simple improvements to product detail, clearer return policies, better packaging and the use of routing tools all help lower associated costs.

The retailers who put time into strengthening their returns process now will be in a stronger position as the reverse logistics market continues to grow.

Done well, a clear and efficient returns system becomes a reason customers come back, not a reason they leave.

Feel free to get in touch for more information on how delivery teams can handle returns with ease.